NetSuite vs QuickBooks

Table of Contents

NetSuite vs Quickbooks – Overview

Why should you consider switching your ERP system to NetSuite? Are your business operations growing? Need a more complex system? While plenty of businesses begin with Quickbooks ERP for core processes, oftentimes these businesses begin to outgrow this software solution and decide it is time for an upgrade. Although both Quickbooks and NetSuite can manage accounting solutions, there are major gaps that Quickbooks does not meet which is why NetSuite is regarded as one of the best ERP systems.

Quickbooks

Quickbooks is an enterprise resource planning system that requires more manual processes. Since it is software in which it has no cloud services, businesses must search for a third-party hosting company to have the benefits of a cloud. Although, this means that with an added vendor managing a manual inter-company transaction there will be communication gaps and errors with data. Unfortunately, with Quickbooks’ traditional accounting solutions, their capabilities are limited. Quickbooks fails to meet functions such as automation, subscription billing, asset management, and reporting, often times this leads to issues such as redundant processes and duplicate work.

NetSuite

On the other hand, is NetSuite ERP, a system with advanced features that can integrate different parts of a business into one platform. Supporting business at every stage through its lifetime. This unified platform can provide real-time data with customizable components and dashboards. It goes beyond accounting functions, serving different departments of an organization such as boosting operational efficiencies through customer relationship management, human resource management, automation, and much more. Being designed for a cloud structure analytic data is always accessible without any additional vendors or infrastructure. As an accounting solution, NetSuite is able to manage end-to-end tasks such as cash flow & revenue management, automatic quote-to-order fulfillment, and integrated planning & budgeting, going above and beyond basic bookkeeping.

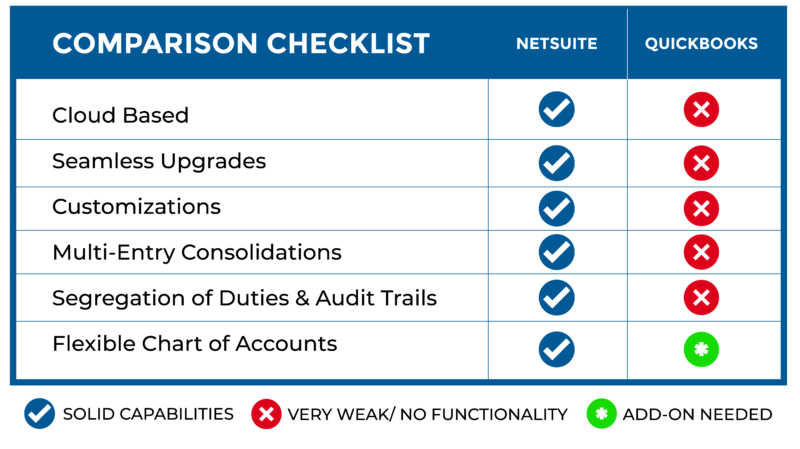

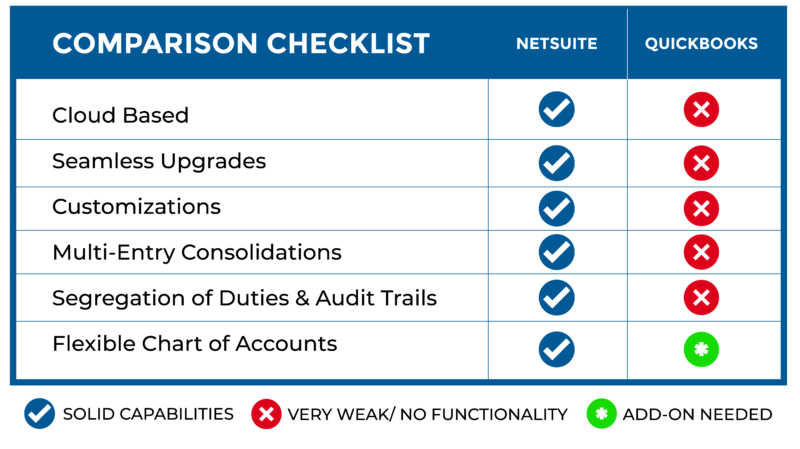

Feature comparison – NetSuite vs QuickBooks

Quickbooks meets basic business requirements for small businesses due to its ability to accommodate bookkeeping tasks, such as managing invoices and basic cash flow tracking. General month-to-month reports with the main task of bookkeeping small businesses manage. It checks the boxes for standard procedures while NetSuite offers bookkeeping and more, a complete financial solution that increases efficiency. As a business grows, NetSuite is capable of supporting the growth by reducing headcounts, preconfigured KPIs, workflows, customizable dashboards, and more! In basic terms, NetSuite has the capacity to do more for your business’s financial operations, by combining the core finance and accounting functions with a heavy focus on compliance.

Financial Management – NetSuite vs QuickBooks

When it comes to business financial tasks NetSuite allows business owners to have more transparency with features such as consolidated reports and invoicing, automated processes, and support of multiple pricing models when it comes to billing features. Accounting data can be brought down to individual transactions where your general ledger (GL) can be tailored to your entire business. GL business processes reduce time and effort for a superior experience. Accounts payable (AP) functions with NetSuite enforces segregation of duties through controlling functionality users are permitted to, this allows for users to be held accountable and to avoid situations such as embezzlement. NetSuite’s accounts receivables (AR) functions to assist in managing tasks such as customer invoices, tracking receivables and receiving payments avoiding entering details such as debits and credits, and much more. Accountant users truly benefit from automating their tasks in return also giving them more time for other productive tasks. Netsuite serves as one of the top ERP systems that offer an all-in-one accounting platform when in comparison to Quickbook’s basic features.

\In addition to NetSuite’s accounting processes, it is also able to sustain other key business processes such as revenue recognition of sales transactions by enabling teams to comply with requirements and setting up automation for revenues to be recognized instantly. With the management of asset lifecycles, reports are available on fixed assets, tracking depreciation expenses, revaluation, and disposal of company assets. Other factors such as inventory management are also another added bonus to this business accounting software. Inventory management allows for clarity of stock levels. It minimizes manual processes by real-time visibility providing insights for the company’s decision-makers. Finally, reporting for NetSuite has a variety of features from standard accounting reports to others such as real-time reports, revenue forecasting, expense tracking, and consolidated parent and subsidiary reports, all while meeting reporting requirements. The overall supply chain management and human capital management aspects of the business are all taken care of with this all-in-one platform.

Why trust NetSuite over QuickBooks?

When trying to scale your business, NetSuite will not cause limitations, with the added number of customers, employees, increased data greater automation will be required. In this case, NetSuite serves as a foundation for a rapidly growing business offering advanced reporting and business applications. Previously companies entering new regions, business leaders manually would do tasks such as pulling monthly depreciation and amortization reports from spreadsheets, not only a tedious task but highly prone to error. Now with NetSuite, it basically just comes to a push of a button. NetSuite also supports growth in different regions by complying with different standards and requirements.

With Quickbooks, there are limitations. Organizations must layer more systems or applications to meet different purposes, such as procurement, revenue management, inventory management, and more. These become added costs and it also becomes added responsibility for the finance departments, this reduces efficiency, allowing more room for errors and increases spending.

When implementing NetSuite ERP your business can excel when the time comes to scale. Business owners need a business solution in which is more functional and less daunting. A system where there are no headaches for employees and tasks can be completed with efficiency. Basic functionality does not support growth for business models in the long term, as more complex platforms are needed. Ditch basic platforms and watch your business performance gain advanced functionality with no additional costs when implementing NetSuite, the market leader of ERP systems.

Working with ERP Buddies