How Does NetSuite General Ledger Contribute to Cost Optimization and Financial Management?

Turning NetSuite General Ledger into a Dynamic Business Asset:

The NetSuite GL feature stands as a cornerstone for financial stability for businesses. The comprehensive features justify NetSuite pricing through meticulous attention to detail and functionality. In the intricate world of modern finance, where duteous record-keeping, accuracy, and real-time insights are paramount, NetSuite’s General Ledger is a steadfast ally. It provides organizations with a robust and agile platform to manage their financial data, offering a comprehensive and granular view of their financial health. This tool streamlines financial reporting and facilitates strategic decision-making by empowering businesses with real-time data analysis.

What is NetSuite General Ledger?

NetSuite General Ledger is an advanced financial management tool that automates essential accounting procedures and offers a highly adaptable structure tailored to the specific needs of organizations. It allows customizing account types, transactions, and reporting segments to align with unique business demands. By incorporating features like real-time bank integration, rule-based transaction matching, and automated journal entry posting, NetSuite reduces the reliance on manual data input. This comprehensive system equips finance and accounting professionals with the necessary resources to ensure precise financial record-keeping, generate detailed reports, and efficiently close financial books within specified timeframes.

Reliable Data:

Bid farewell to erroneous formulas within spreadsheets. By consolidating all your financial data into a single location, you gain access to precise numbers and experience seamless reconciliation processes. NetSuite ERP synchronizes all your data.

Transition from Static to Dynamic:

NetSuite ERP enables the transition from a static to a dynamic approach with your general ledger. NetSuite empowers you to tailor the operation of your GL to align seamlessly with your business’s distinctive structure and needs, offering custom workflows, transaction types, and more under your control.

Run Business from Anywhere:

Manage your business from anywhere by accessing your financial records anytime, using any internet-connected device, whether a phone, tablet, or computer. This ensures that you’re consistently in control of your business’s financials.

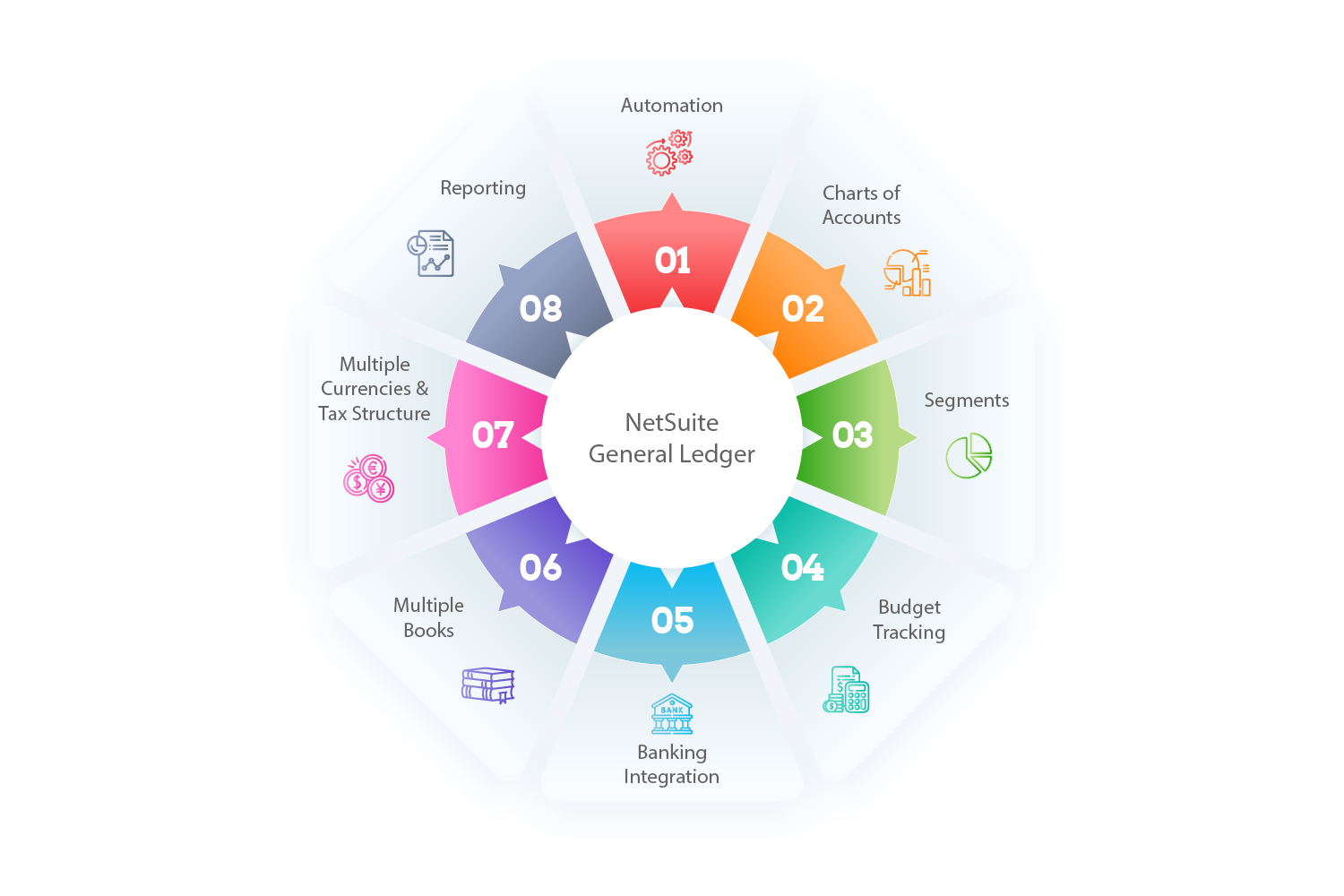

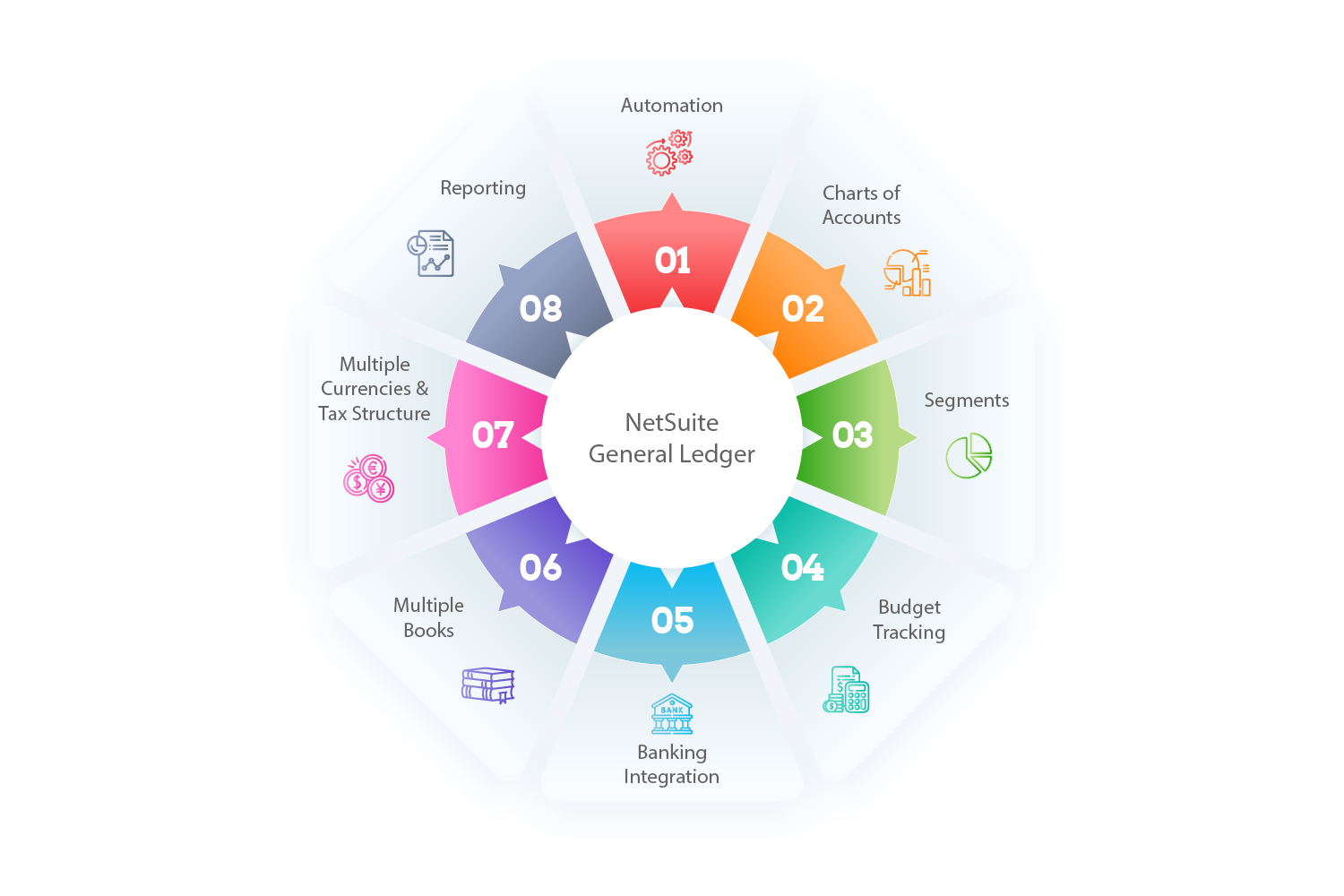

Features of NetSuite General Ledger

The general ledger is the fundamental backbone of any accounting system, and its vitality lies in its ability to be dynamic, adaptable, and scalable. In this regard, NetSuite’s general ledger provides companies with a robust platform that offers the essential flexibility, insights, and control required to address the ever-evolving demands of modern businesses effectively.

NetSuite’s general ledger stands out for its adaptability, allowing organizations to tailor it to their specific needs and evolving business requirements. Whether customizing workflows, defining unique transaction types, or accommodating complex reporting structures, NetSuite’s general ledger ensures it seamlessly aligns with an organization’s distinctive financial processes.

The dynamic nature of NetSuite’s general ledger empowers companies with invaluable insights. Real-time data integration and reporting enable finance professionals to access accurate and up-to-the-minute financial information. This level of transparency facilitates data-driven decision-making, giving businesses a competitive edge in the fast-paced business landscape.

- Automation:

NetSuite’s General Ledger system eliminates the need for manual journal entries by enabling custom impact lines on transactions across multiple accounting books. This automation significantly reduces the time and effort required for account reconciliation, financial closes, and audits. It incorporates approval workflows with specific criteria, enhancing accuracy and compliance. Additionally, NetSuite automates processes such as amortization, depreciation schedules, and profit and loss allocations, leading to greater efficiency and reduced errors in financial management.

- Charts of Accounts:

A chart of accounts is the foundational framework for organizing financial transactions and data within an organization. Traditionally, it relied on complex tracking codes, which could be time-consuming and error-prone. However, introducing a simplified chart of accounts structure has revolutionized financial reporting, making it more user-friendly and efficient. This streamlined approach enhances clarity, reduces errors, and accelerates reporting, providing accurate and timely insights into financial health. The simplified chart of accounts significantly improves financial management, contributing to organizational success and growth.

- Segments

NetSuite’s custom General Ledger segments offer a wealth of possibilities by allowing organizations to define a wide range of categories, including profit centers, funds, programs, and more, in addition to standard segments like subsidiary, class, department, and location. These segments play a crucial role in improving financial accuracy and efficiency. They enable precise data capture and categorization tailored to unique business needs, providing detailed insights into revenue sources and cost centers. Moreover, these segments uphold the integrity of double-entry accounting principles, ensuring accurate and compliant financial records across all combinations. This capability empowers organizations to gain control over their financial data, streamline processes, and make informed decisions, ultimately leading to improved financial outcomes.

- Budget Tracking

Unlock the power of real-time budget tracking with NetSuite, allowing you to monitor revenue and expenses compared to pre-established budgets effortlessly. These budgets can be generated using NetSuite Planning and Budgeting tools or imported as .csv files. This functionality provides businesses with invaluable insights into their financial performance, enabling prompt adjustments and informed decision-making to ensure budget adherence and financial success.

- Banking Integration

Achieve instant access to critical cash flow insights through seamless banking integration in NetSuite. This feature facilitates connectivity with a vast network of global financial institutions, automatically importing bank and credit card data directly into the NetSuite system for effortless reconciliation with general ledger accounts. Utilizing an intelligent rules engine, NetSuite intelligently cross-references bank data with existing transactions, streamlining the reconciliation process by automatically matching entries and highlighting exceptions for prompt resolution, ensuring financial accuracy and efficiency.

- Multiple Books

With NetSuite’s multi-book accounting capabilities, you can streamline your accounting and reporting processes, eliminating the need for duplicated data entry and minimizing error-prone manual adjustments. This feature simplifies the management of multiple books that adhere to different accounting standards. It achieves this through prebuilt mapping functionalities that connect primary and secondary charts of accounts, along with book-specific functional currencies. NetSuite’s multi-book engine records all book-specific activities stemming from a single business transaction within the general ledger, encompassing tasks such as revenue recognition, expense amortization, depreciation, profit and loss allocations, and more.

- Multiple Currencies & Tax Structure:

Ensure precision in your tax records across diverse currencies and tax structures, regardless of your customers’ and partners’ global locations. NetSuite enables concurrently recording transactions in local currencies and your company’s base currency, simplifying the process. It automates currency conversions, utilizing current exchange rates to enhance efficiency and reduce errors. Additionally, NetSuite facilitates compliance with local and international tax regulations, encompassing income, VAT, and other sales and use levies.

- Reporting:

With custom reporting segments, you can perform multidimensional financial and operational data analyses. NetSuite also offers automatic consolidation of subsidiary financials and enables the creation of reports based on multiple accounting standards. Furthermore, you can schedule reports for generation and email delivery daily, weekly, or monthly.

Benefits of NetSuite GL

NetSuite’s General Ledger offers a myriad of advantages that significantly enhance financial management. It adds efficiency by automating various aspects, including journal entries, data imports, transaction matching, and bank reconciliation, thereby saving valuable time. The system also contributes to heightened accuracy by eliminating the complexities associated with GL codes, ensuring high-quality reporting data. Custom reporting segments and multidimensional analytics provide valuable insights for informed decision-making. NetSuite’s global capabilities allow multiple sets of books to comply with diverse accounting standards, tax regulations, and reporting requirements, making it ideal for businesses operating internationally. Additionally, it expedites consolidation by automatically rolling up financial results from subsidiaries, reducing the need for manual adjustments, and streamlining the closing process by minimizing data-entry errors and missing transactions through automated account reconciliation and exception management.

Challenges NetSuite GL Solve

NetSuite General Ledger effectively addresses several critical challenges, optimizing financial processes for businesses. It eliminates inefficient manual procedures by automating tasks such as journal entry creation, bank and credit card account reconciliation, and consolidated financial statement generation. NetSuite also simplifies complex Chart of Accounts management by enabling the support of unlimited accounts and sub-accounts without the need to capture operational details for reporting. Additionally, it provides flexibility in the General Ledger structure, allowing customization of account codes, transaction types, GL impacts, and reporting segments to align with the unique business structure of each company. NetSuite streamlines the closing process with features like automated transaction matching, exception management, approval workflows, and a customizable close-management checklist. Moreover, it facilitates financial consolidation by automatically aggregating subsidiary-level reporting data into consolidated financial statements, simplifying complex financial reporting requirements.

NetSuite’s General Ledger emerges as a transformative force in financial management, offering comprehensive features and solutions that streamline operations and empower businesses to thrive in today’s fast-paced and intricate economic landscape. Whether through automation, dynamic customization, or global compliance, NetSuite’s General Ledger is instrumental in overcoming challenges, unlocking efficiency, and delivering actionable insights for informed decision-making. As businesses seek precision, scalability, and financial acumen, NetSuite’s meticulous attention to detail and functionality make it a compelling choice that justifies its pricing and reinforces its position as a trusted partner in pursuing financial success. NetSuite’s pricing is justified by its conscientious features, offering a comprehensive suite of tools that streamline financial processes and enhance decision-making. Inquire your NetSuite partner about this feature while getting NetSuite.

Come say "Hi"

Partner with ERP Buddies, aN ERP Solution Provider

ERP Buddies is a Global ERP Solution Provider with diverse experience in implementing and Supporting NetSuite ERP for many industries.

With operations in the North America, Europe, Asia and United Kingdom, our Expert Team is accessible globally. It is their priority to create a smooth and positive experience for clients. Our experts assist clients throughout the entire implementation process, with on-site support and consultation and additional assistance in customizing your system to guarantee it meets your business needs. For our contact info, click below, and personnel for review will be in touch.

We can’t wait to get in touch with you!